When playing a breakdown or a break higher, positioning the trade well is crucial for three reasons, which I'll address in this article:

- Having a lower cost of information.

- Reducing the risk and workload from a failed break.

- Gaining a positional advantage when the break is successful.

Let's start with some examples...

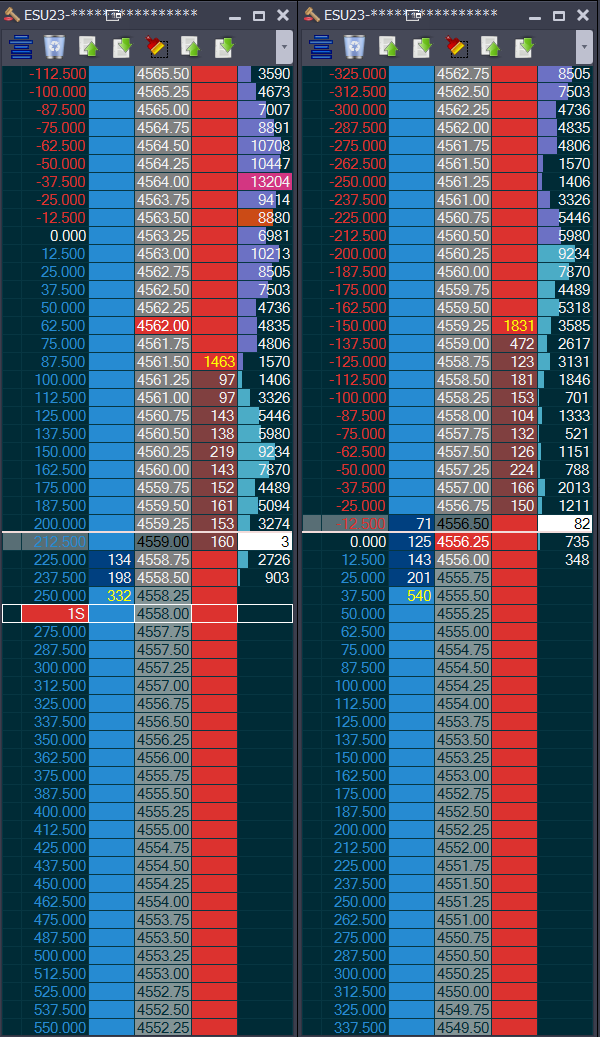

Consider the following two trades:

Trade #1

The trade on the left is ideal from this perspective for a few reasons. We've created green (or in the case of this system, blue) space by managing the position's size. This space takes in the entire area out of value, which, as you can see, is also an area of two-sided trade. This breathing space allows us to exit much more comfortably if buyers were to jump in immediately short of the session low. Even if the extra resting order below the low is triggered, the positional advantage that's been created will ensure that there's no increase in mental workload even if the situation changes as I described. The break failure and having to take a little less than hoped for would be disappointing, but as traders, we need to be able to handle that at times.

Trade #2

Trade #2 is too initiative. That is to say, it's too close to the breakpoint and any drift away is likely to trigger an increase in mental workload if anything other than the breakdown were to happen. If the failed break situation I described in trade 1 were to happen here, I would need to scramble for the exit rather than calmly working an exit as I should be. The cost of information is too high in the trade, meaning that it would cost more ticks to be wrong than I would be likely to gain if the market were to slowly grind lower.

Mental Workload

As a short-term trader in particular, managing your mental workload is crucial to success. Different people will have different experiences of faults in this situation, but taking trade #2 repeatedly is a good way to increment the tilt-o-meter. You want it to work immediately because the chance of a loss is higher. If it doesn't, you're left trying to work out whether the move against you is a temporary phase of play or a more permanent issue, and we all know that when things are going wrong, those lights flicker more and more quickly. This is, of course, why a lot of people talk about setting a stop loss beforehand, but for a more discretionary trader, where would that trade be invalidated? Are there factors elsewhere (such as NQ and YM being rooted to their lows and breaking down in this case) that are still giving some confidence of success? Your mind's reaction to these stimuli will determine your likelihood of making the correct decision on this trade. Assuming that we're not being bombarded with unnecessary information from other tools, we can use the facts generated within the auction and the correlation block to either stay in and take profit, or take a manageable loss.

To sum up

Calmness and professionalism are the keys to avoiding any unnecessary panic when trading. As your mental workload increases in a trade, your chance of remaining calm and professional decreases commensurately. Example trade #2 has the ingredients of a losing position; overly initiative entry and a high cost of information if the idea turns out to be wrong. Taking better positions within the structure as is the case in example trade #1 is likely to lead to a much less panicked trading experience if the tide turns against you.